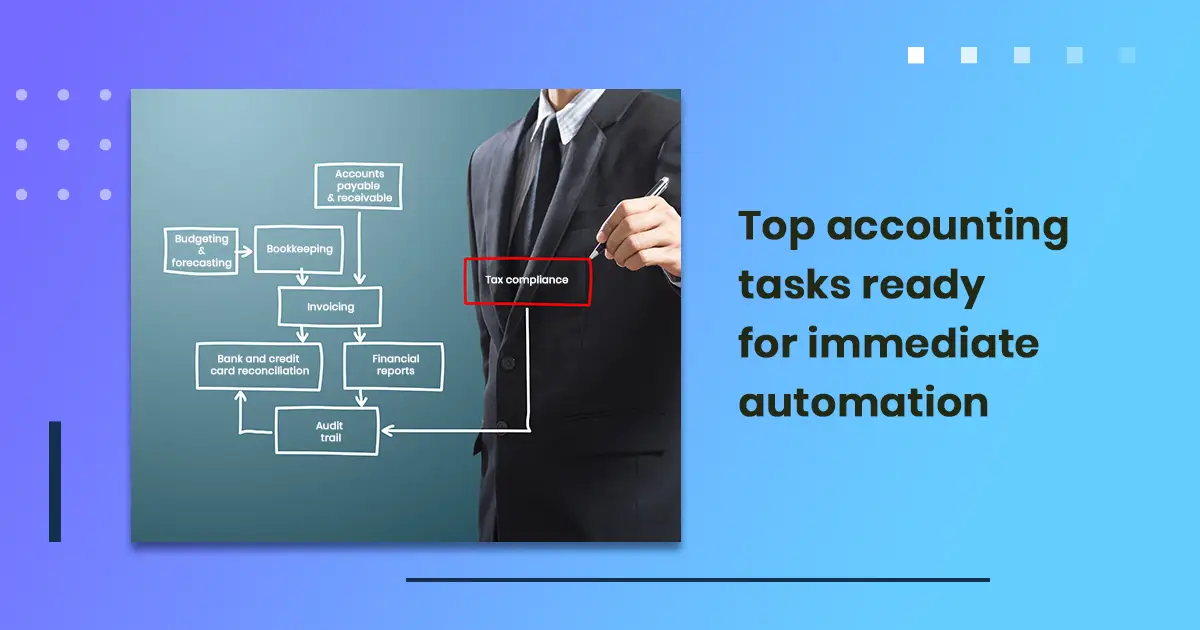

Top accounting tasks ready for immediate automation

Dec 29, 2023

What is the role of automation in modern accounting?

Automation is revolutionizing the accounting industry by streamlining processes, reducing human error, and allowing accountants to focus on strategic decision-making rather than mundane tasks. Modern accounting software harnesses the power of artificial intelligence (AI) including Generative AI, Agentic AI, and machine learning to perform repetitive and data-intensive tasks more efficiently than manual methods. This transformation not only enhances accuracy and compliance but also provides real-time insights that are critical for decision-making.

Why should small businesses automate their accounting processes?

Accounting automation is not a luxury for small businesses; it is an imperative need. With limited resources and workforce, small businesses can gain a lot from the efficiencies that automation brings. Small businesses will benefit from such automated accounting processes and perform tasks within a particular function, such as:

- Save Time: Automation of repetitive tasks frees up more time for the practice owners and staff to focus on growth and customer service.

- Reduce Costs: It also reduces labor costs and a number of potential financial losses due to errors that could be made by employees who perform extensive manual labor.

- Enhance Accuracy: Automated systems are less prone to various human errors, thus ensuring the accuracy and up-to-date condition of the financial records.

- Improve Compliance: Automation helps in maintaining compliance with tax regulations and financial reporting standards by ensuring that all records are consistently and correctly maintained.

- Gain Real-time Insights: Automated systems provide real-time data and analytics that management can use to make smart choices related to the financial state of affairs as they evolve. Generative AI can create detailed financial projections and analyze these insights for strategic decision-making.

Routine accounting tasks to be automated right away

Data Entry and Bookkeeping: Manual data entry is time-consuming and full of errors. Automation tools, powered by Agentic AI automate tasks in data entry by auto-importing data from bank statements, invoices, and receipts into accounting software. This doesn't only improve the speed of bookkeeping but also its accuracy to a great extent.

Financial Reporting: Generating financial reports is a critical yet repetitive task. The automated financial reporting tool will be capable of drawing out data from various sources, generating an error-free report on balance sheets, profit, and loss statements, and cash flow statements. They can also customize reports to meet specific business needs and compliance requirements.

Bank Reconciliation: This is very time-consuming, comparing bank statements against the internal record of entries. Automated reconciliation tools, including those powered by Agentic AI, can map the transactions emanating from bank statements with those recorded in the accounting system to identify discrepancies and ensure records are accurate.

Expense Management: It is the system of capture and organization of expenses as they occur. The mobile applications enable staff members to scan their receipts, which are then captured automatically and uploaded into the accounting system for improved efficiency in expense reporting. This will also reduce the risk of losing receipts.

What improvements does automation bring to payroll processing?

Automated payroll processing significantly enhances the efficiency and accuracy of managing employee compensation. Here are the key benefits:

Accurate Calculations: Automation will ensure that payroll calculations are correct, showing the number of hours worked, overtime hours, deductions, or benefits. This reduces errors and ensures employees are paid correctly.

Timely Payments: On-time scheduling and processing of payroll through automated systems ensure that wages of employees are not delayed. This itself is one big factor in keeping the satisfaction and morale of the employees in check.

Compliance with Regulations: Payroll automation complies with tax laws and labor regulations due to the fact that at each and any instance the program is updated for the latest rules and rates. These reduce the risk of non-compliance and resultant fines.

Efficient Record Keeping: All activities regarding transactions that have been processed go through detailed records kept by any automated payroll system. Hence, the organizations can easily retrieve information for older periods not only in case of audits but also when reporting is required.

How can automation streamline accounts payable and receivable?

Accounts payable automation and accounts receivable automation are crucial for maintaining healthy cash flow and financial stability. Here’s how automation streamlines these processes:

Invoice Processing: Automated systems can receive, process, and approve invoices electronically. This speeds up the approval process, reduces the risk of errors, and ensures that payments are made on time.

Payment Processing: Automation handles the scheduling and execution of payments, ensuring that vendors are paid promptly. This helps businesses maintain good relationships with suppliers and may even qualify for early payment discounts.

Tracking Receivables: Automated accounts receivable systems monitor outstanding invoices and send automated reminders to customers. This reduces the time spent on collections and improves cash flow by ensuring timely payments.

Reporting and Analytics: Automated systems provide detailed reports and analytics on payables and receivables, giving businesses insights into their cash flow and helping them make informed financial decisions.

Conclusion

Accounting automation is aligned with a wealth of benefits to provide any size of firm with time and cost savings, accuracy, and compliance. With the automation of routine tasks in data entry, financial reporting, payroll processing, payable and receivables, a practice has time and chance to focus on strategic growth and decision-making.

Integra Balance AI is one of the leading solutions for accounting automation. That is a state-of-the-art AI-driven platform that allows complete automation of reports, from bookkeeping to expense management. With an intuitive interface and powerful analytics tools, Integra Balance AI will assist practices in automating accounting processes and getting insight into their bottom line.

Accounting automation is no longer an option; rather, it is a necessity if one wants to be competitive in today's fast-moving industry. State-of-the-art technologies like Integra Balance AI help practices change the way they do their accounting—in search of higher efficiency, accuracy, and strategic success.

Schedule Your Free Demo

With our accounting automation experts

Find out how other practices have benefited using Integra Balance AI bookkeeping automation. 87% of practices who viewed AI bots in action have instantly discovered the advantages of using them at their firm.

Global Offices

US (Head Quarters)

Integra Global Solutions Corp

7500 Brooktree Road, Suite 100

Wexford (Pittsburgh)

PA 15090

+1 412 267 1529

Philippines

Integra Global Solutions Corp

Ayala Cebu Tower,

Cebu Business park, Cebu 6000

+1 412 267 1529

Europe

Integra Global Solutions UK Ltd

College House

17 King Edwards Road

Ruislip, London, UK, HA4 7AE

+44 (0)20 7993 2949

Canada

Integra Global Solutions Corp

32 Blencathra Hill, Unit 100, Markham

Ontario

+1 412 267 1529

India

Integra Global Solutions Corp

First floor, Kanapathy Towers,

Opp.BSNL exchange, Ganapathy,

Coimbatore – 641 006, India

+91 (0422) 437 9555

Australia

Integra Global Solutions Corp

+61 02 8005 1836